What is Sukanya Samriddhi Yojana?

Sukanya Samriddhi Yojana is a savings scheme launched on 22nd January 2015 by the Government of India for parents and guardians blessed with a girl child. This scheme aims to help parents or guardians to build funds for future expenses of a girl child such as education and marriage.This flagship scheme was launched by Honorable Prime Minister Shri Narendra Modi as a part of the campaign- “Beti Bachao, Beti Padhao”.

Key Features of Sukanya Samriddhi Yojana (Updated)

| Eligibility | A/C can be opened for girl child before the age of 10 years |

| Initial Deposit | Account opens with initial deposit of Rs. 250/- |

| Interest Rate | 8.5% per financial year notified by Government (Updated) |

| Returns | E.g. Rs.1000/- invested per year would get Rs. 46812/- after 21 years at the time of maturity |

| Tenure for Deposit | The maximum tenure for deposit is 15 years. Life of Account is maximum 21 years from the date of opening |

| Tax Exemption | Tax is exempted on Deposits, Interest earned and the Withdrawal amount. |

| Withdrawal | Allowed only after the age of 18 years for Higher education or Marriage |

| Closure | Allowed only in exceptional cases:

|

| Penalty and Late Fees | Minimum amount of Rs.1000/- is required to maintain account. Failure to do so results in account dormant. This can be revived by paying penalty amount of Rs.50/- per year and the minimum amount required. |

Documents Required:

- Age Proof : Birth certificate of Girl Child

- Residential Proof: Address proof of legal guardian

- Identity Proof: Aadhar card or Voter ID of guardian.

Common Questions about Sukanya Samriddhi Yojana

-

Who can open an Account?

Sukanya Samriddhi Yojana account can only be opened by the parents or guardian of the girl child. The scheme is only valid for up to two girl child sharing the same parents. Every girl child should have an individual account opened separately. Exemptions are there in the case of twins or triplets with the help of a competent medical institution and producing a medical certificate.

-

Age Limit

The Sukanya Samriddhi Yojana account can be opened till the girl child attains the age of 10 years. However, the eligibility criteria for parents to open an account is only for girl child who took birth after 2nd December 2003.

-

Where to Open an Account?

You can open an account by visiting any Post office, Government bank or even some Private banks. Some of the banks assisting in opening the SSY Account are ICICI, Axis, HDFC, Union Bank of India, Allahabad Bank, Canara Bank, Punjab National Bank, Bank of Baroda. More banks are being added to the list from time to time.

Sukanya Samriddhi Yojana is also available in State bank of India.

-

Documents Required

Identity proof of the parents/guardian with the address proof (electricity bill, landline telephone bill, driving license, passport, ration card, etc.), birth certificate of the girl child must be available at the time of opening the account.

-

Maximum and Minimum Deposits

Earlier, the initial deposit to open an account was Rs. 1000. The government of India amends the Sukanya Samriddhi Yojana account rules, and the initial deposit is now Rs. 250 for opening an account. This move will enable more people to take advantage of the scheme. The maximum amount that can be deposited in the bank account is Rs. 1.5 lacs and the total money deposited at the end of every financial year can’t exceed this amount. There is no restriction on the number of deposits in a month or every financial year.

-

Interest rate

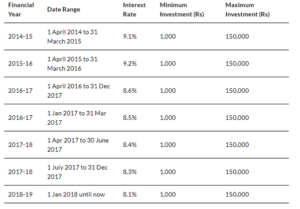

This scheme is the first small savings scheme that offers the highest interest by the government of India. The rate of interest for the financial year 2014-15 was 9.1%. This later elevates to 9.2%. Later on, the rate of interest was revised to 8.6% from the financial year 2016-17. The interest rate for the year 2017-2018 is 8.1%. The interest compounds annually beginning from the date of opening and then credits into beneficiary’s account when the deposits mature or when the account holder withdraws the money.

The account holder can also opt for monthly interest instead of yearly. In that case, the same calculation occurs on the basis of the balance in the account regarding thousands. The remaining amount keeps earning interest at the current rates. The interest rates of the scheme is under revision every quarter.

-

Maturity

You can make the deposits only until 14 years since the date of opening the account. The account will mature only after 21 years since the account opening date or when the girl child is ready for marriage, whichever comes earlier. The female child can’t continue the account once she enters the wedlock.

Premature withdrawal is allowed which involves withdrawing the amount before the maturity period of 21 years. This can only be done by the girl child in whose behalf the account has been created once she attains the age of 18 years. Only 50% of the balance amount from the end of the preceding financial year is available for withdrawal. You can make the premature withdrawal for marriage or higher education purposes with the minimum deposit of 14 years.

-

Tax Benefits

Sukanya Samriddhi Yojana enjoys the benefits of section 80c of Income Tax Act (1961). The entire amount of maturity along with interest you earn is non-taxable if the contributions are up to 1.5 lacs.

-

Can NRI apply for Sukanya Samriddhi Yojana?

The short answer is No. NRIs can open the Sukanya Samriddhi Yojana Account for the Girl Child but the Girl Child should be a resident of India at the time of account opening and also she should be a resident at the time of maturity of investment in Sukanya Yojna.

Updates to SSY (Sukanya Samriddhi Yojana) Scheme

- Any Guardian can open the SSY account for a Girl Child including adopted Girl child.

- Amount can be deposited through Online channels as well.

- Interest Rate would be calculated on 10th Day of every month. Initially it was 5th day of the month.

- Partial withdrawal for girl child education can be done when she has cleared 10th Class or turned 18 years.

- The Amount in the SSY Account will not earn any interest after it has matured.

- Now can now transfer you SSY accounts. post office to post office transfer is free. Transfer from Post office to Banks or vice versa would cost you INR 100/- and can be done only once in a year.

- Duplicate passbook is available at the cost of INR 50/-.

- Full amount can be withdrawn when girl child turns 18.

Important to Note details

If in any case, there is a change in the residential status of the girl child and it’s moved outside India. The parents or guardians must report this in the designated post office or bank. Any interest is credited back to the government in the form of earnings, and the balance is returned to the account holder/investor.

The facility to initiate transfer of money online is also available. The account holder can link their bank accounts with the Sukanya Samriddhi Yojana Account. This saves the efforts to physically visit the bank and post offices and transfer the annual amount on-line. You cannot close the account before the completion of a specific time period. Premature closures are only valid when the deposits occur for a minimum of 5 years (lock-in period).

Sukanya Samriddhi Yojana Calculator

Sukanya Samriddhi Yojana calculator provides you with the exact forecasting of your investment. It enables you to plan according to the results that display for the future. You can use any compound interest calculator to project the savings depending upon your circumstance.

Interest Rates notified by Government since the scheme was launched

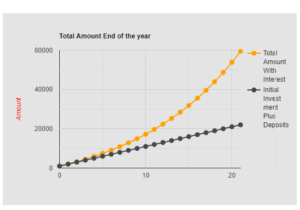

Growth Calculation for Sukanya Samriddhi Yojna

If you start with Rs.1,000.00/- in a SSY account earning a 8.5% interest rate, compounded Annually, and make Rs. 1,000.00 deposits on a Annual basis; After 21 Years your savings account will have grown to 59,414.51 — of which 22,000.00 is the total of your beginning balance plus deposits, and 37,414.51 is the total interest earnings.

See the Growth Graph and the Interest Earnings.